When Is It Time for Your Small Business To Outsource Bookkeeping?

1. You spend more time as a CBO (Chief Bookkeeping Officer) than a CEO

Multitasking could be costing your company productivity. According to an American Psychological Association research, mental blocks due to repeatedly switching between tasks can cost up to 40% of an individual’s productive time. So, it may be high time to outsource your accounting services if you spend too much time managing your financial books, payroll, and other accounting-related matters while working with your clients.

A growing small business that tries to “do it all” may end up with more pain than gain when developing and maintaining a well-managed bookkeeping team and institutionalizing best practices for financial system design and integration. Due to lack of training or overworked employees, improper or inefficient bookkeeping practices result in inaccurate financial data, delay in financial reporting, and financial instability.

Outsourcing your bookkeeping services may be a realistic alternative in establishing the requisite internal capabilities from the ground up if your business is deeply reliant on a few key personnel to satisfy multiple responsibilities and tasks for the company.

Even if something is deemed “good enough,” you’re probably squandering an excellent opportunity to transform a routine chore into a strategic goldmine opportunity.

2. You haven’t established Good Internal Control on the Separation of Duties and Responsibilities.

Suppose the same individual writes your checks and reconciles your bank statements. In that case, your company may lack internal control on a clear separation of duties and responsibilities, putting your small business at risk of fraud.

There are various occupational fraud methods used by thieving personnel to relieve you of your income, ranging from billing and payroll theft to check tampering and skimming. Many small and growth-oriented companies neglect the need of developing risk-reduction systems and methods despite being a substantial investment that can reduce, if not eliminate, the impact of occupational fraud where a typical surveyed business had a $150,000 median loss per case.

The main objective of good internal control is to safeguard assets and prevent and detect fraud, making it more difficult to steal and quickly discover the deception. Internal controls ensure that the flow of information into your financial system is correct, timely, and classified in the correct period, in addition to limiting fraud risks.

By establishing high standards now, your company will be able to obtain the high-quality data it requires in the future to make informed decisions and pursue future strategic opportunities. Regardless of the size or number of personnel in your business, outsourcing your accounting and controller functions will effectively separate duties, giving an additional degree of review.

3. You Don’t Have a Strategy in Place for When Your Current Bookkeeper Resigns.

What happens if your bookkeeper becomes ill, takes a vacation, or, worst of all, resigns? When they’re gone, who will finish their work? If they were to resign, is there a strategy in place for someone to continue where the bookkeeper left off?

At Octopus Bookkeeping, many of our clients who have pursued us and said “Sign me up!” were initially driven by the presence of pain. “My bookkeeper is quitting” is an all too common source of that pain. It’s abundantly apparent what may happen to a small firm if it doesn’t have a dependable and trustworthy bookkeeper to track its finances. The freedom to focus on core capabilities for the company’s overall benefit is the driving reason behind many decisions to outsource bookkeeping in the quest for peace of mind.

Aside from the aggravation of dealing with delayed data entry and reports that are less-than-useful owing to mistakes, obsolete financial processes can truly cost your company a significant sum of money.

4. You make Business Decisions Without Prompt, Precise, and Actionable Financial Data.

You can trust your figures and keep your finger on the financial pulse of your firm when you hire qualified bookkeeping professionals to follow strict record-keeping and KPI reporting. Making data-driven decisions will avoid severe errors with accurate financial intelligence.

Businesses that manage their cash flow annually have a 36 per cent survival rate over five years. In contrast, those who plan it monthly have an 80 per cent survival rate, according to a study done by the Geneva Business Bank. Cash is the lifeblood of every business, and you need to know exactly how much money is coming in and going out to steer your business correctly. Cash flow forecasting is one type of management accounting that can help your company grow.

One of the essential factors in a company’s outsourcing decision is access to service providers’ knowledge, specialty, and world-class skills. Your company receives a competitive advantage while avoiding the costs of pursuing new technology and training by using their considerable investments in technology, techniques, and people. A review of your internal processes is part of Octopus Bookkeeping’s initial setup, which frequently leads to significant improvements in efficiency and performance metrics.

Imagine the power and competitive advantage you’ll get by making strategic decisions based on accurate financial data and vital reports like your Key Performance Indicators (KPIs)!

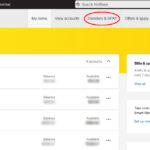

Your business will be better positioned to scale if you outsource your bookkeeping and accounting. As a result, you may focus on the game rather than the books. Outsourcing also means that your most important resource, your staff, may focus on core operations that benefit your customers and create value for your whole organization. Hence, when you delegate management accounting and QuickBooks system management to the specialists, you can concentrate on addressing the demands of your core business – your clients – which is what keeps you in business in the first place.

Companies outsource their bookkeeping because:

- It is cost-effective.

- Experts know best.

- Experts give accurate data.

- Consistent reconciliation is ensured.

- Businesses can concentrate on their core competencies.

- Fraud can be prevented.